SETTING A NEW STANDARD

IN DIGITAL RISK MANAGEMENT

SecondSight is a Vertical AI System

specifically designed for cyber insurance.

SecondSight’s Vertical AI embodies a full-spectrum approach to cyber insurance, facilitating accurate digital risk profiling for companies, strategic risk placement for brokers, and portfolio management for carriers. SecondSight employs state-of-the-art AI and digital telematics to continuously monitor digital risk patterns, providing a robust platform that anticipates and pinpoints emerging risks.

MODERN RISK REQUIRE MODERN EXPERIENCES

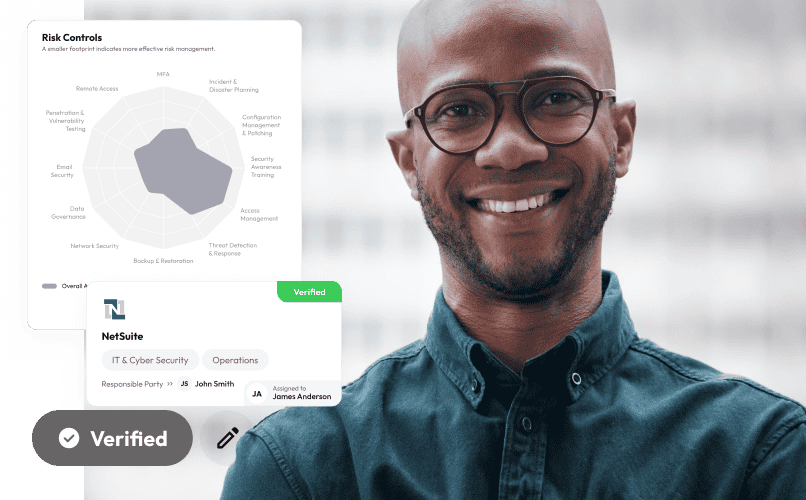

Company Workbench is SecondSight’s integrated platform designed to streamline and optimize the entire digital risk management lifecycle for businesses. It enables companies to profile, transfer, and manage digital risks with precision, offering tools for baseline risk assessment, tailored risk transfer strategies, and continuous risk monitoring.

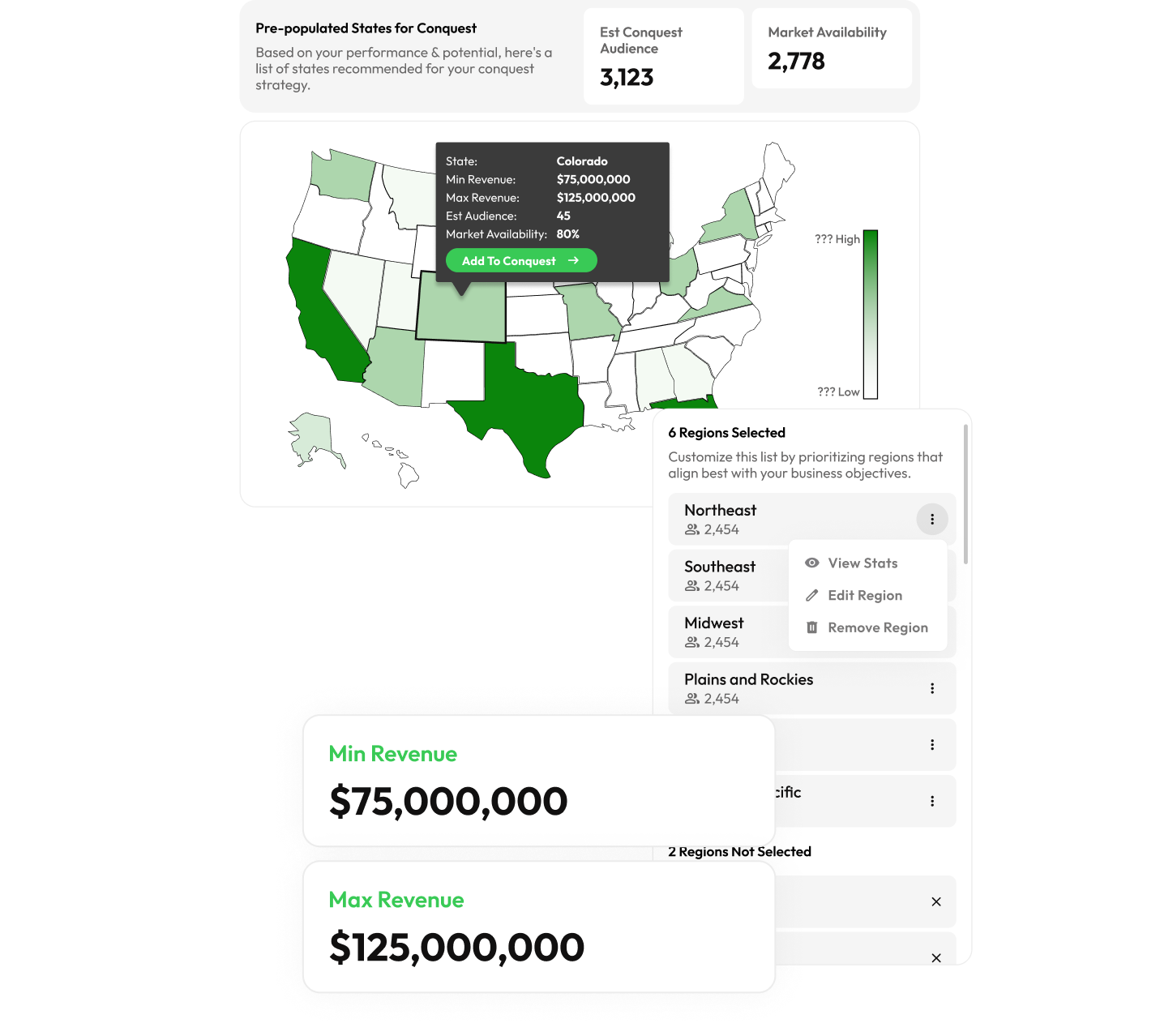

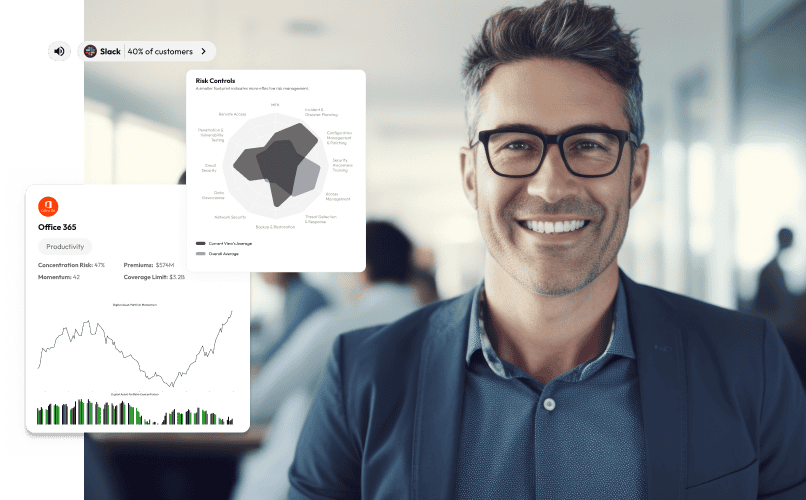

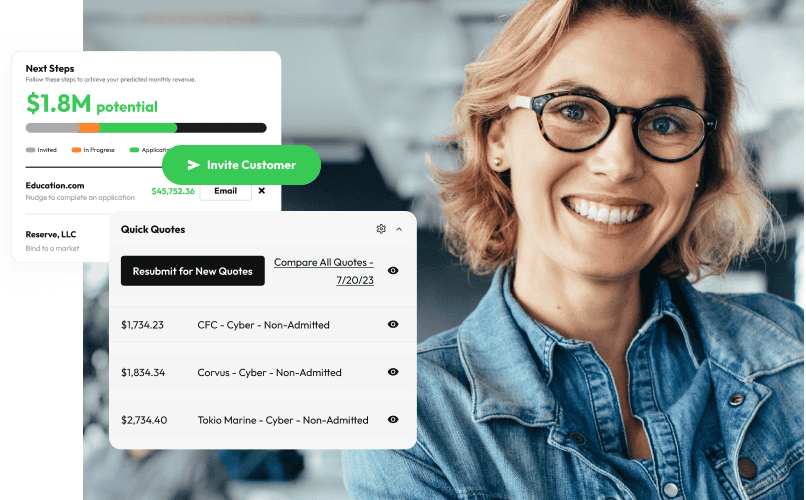

SecondSight’s Broker Workbench is an integrated platform designed to digitize the cyber insurance process for brokers. It combines cutting-edge technology with user-friendly features to streamline the entire insurance lifecycle, from client onboarding to policy renewal and risk management.

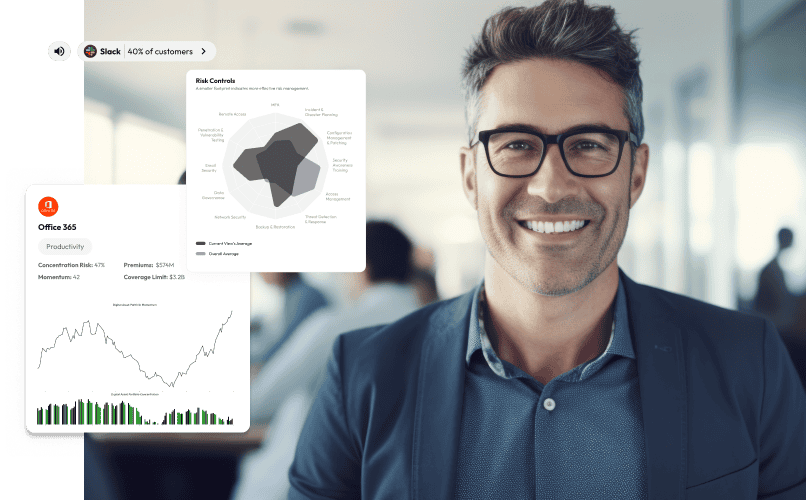

Underwriter Workbench, powered by SecondSight, is a sophisticated platform designed to modernize the underwriting process for cyber insurance. This advanced system offers a comprehensive suite of tools that enable underwriters to navigate the complexities of digital risks with ease and precision.

👋 Brokers

MEET YOUR

CYBER INSURANCE

CO-PILOT

cyber risks are assessed, policies are chosen,

and ongoing risk management is handled

Quote, Compare and Bind Across 18 Top Tier Markets

CYBER INSURANCE, SIMPLIFIED

WITH SECONDSIGHT.

Explore solutions for brokers of all sizes.

A PLAN THAT FITS

YOUR BUSINESS

Designed for individual brokers and offers a focused set of tools for managing client relationships and automating the quote and bind process

Aimed at small teams within brokerages, this package expands on the individual offering by adding team collaboration features and enhanced reporting capabilities.

The most comprehensive package is tailored for large enterprises, offering a full suite of features for detailed risk management, customization, and integration with existing systems.